Choose the CBAM Plan That Fits Your Export Needs

From single quarterly reports to end-to-end yearly support with third-party audit options — pick the compliance package that works best for your business.

Quarterly CBAM Reporting

Starting from ₹ 35,000

- 1 CBAM report

- No query support

- No third-party signatory

Yearly CBAM Reporting

Starting from ₹ 2,00,000

- 4 CBAM reports

- Full year ESG/CBAM query support

- No audit

Yearly CBAM + Third-Party Audit

Starting from ₹ 2,50,000

- Everything in yearly plan

- 1 audit with third-party signatory

- Ideal for official filings or reviews

What is Carbon Border Adjustment Mechanism (CBAM)?

Find out more about CBAM and its impact on your Business

The Carbon Border Adjustment Mechanism (CBAM) is the European Union’s policy to put a fair carbon price on imported goods, ensuring they meet EU Emissions Trading System (ETS) standards.

It applies to non-EU businesses exporting CBAM-covered goods into the EU, that are Cement, Iron and steel, Aluminium, Fertilizers, Electricity and Hydrogen.

If you want to future-proof your supply chain sustainability, CBAM is for you.

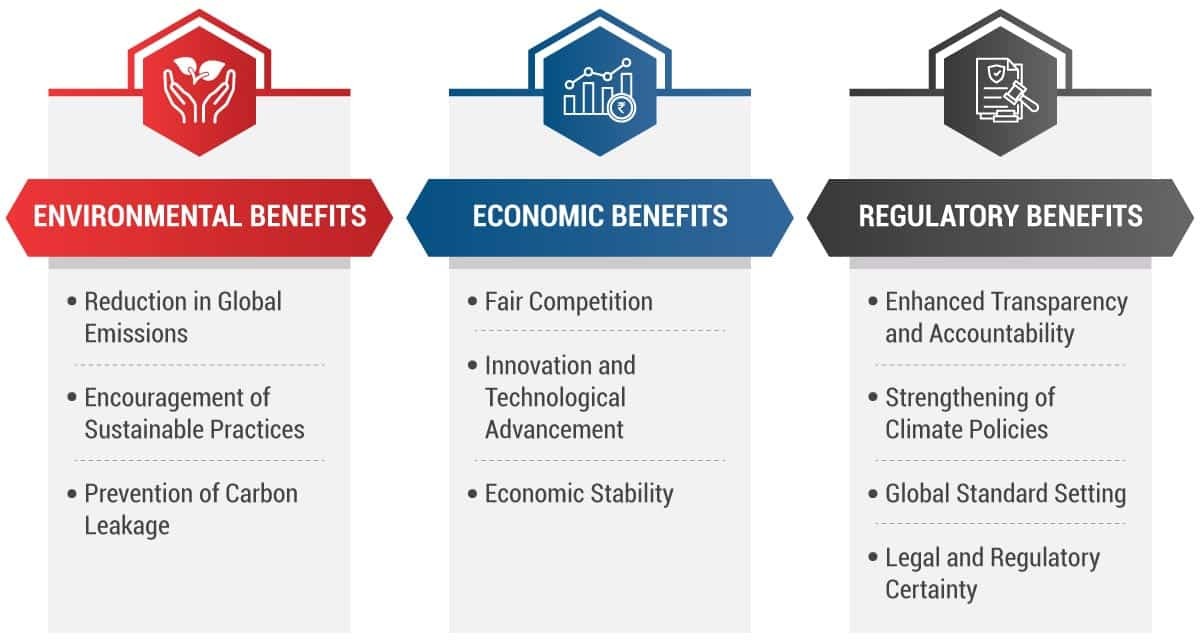

Some key benefits of CBAM are:

CBAM Reporting Services by

InCorp Advisory

Are you ready for CBAM reporting? The EU Carbon Border Adjustment Mechanism (CBAM) is already in effect, and businesses that fail to comply risk losing EU clients, import restrictions, and trade barriers. Our CBAM experts help you navigate the complexities of EU CBAM regulations, carbon pricing, and sustainability reporting with ease.

CBAM Advisory

Get expert guidance on CBAM regulation, quarterly reporting, and carbon pricing strategies to ensure smooth compliance.

Quarterly CBAM Reporting

Accurate, on-time submissions of CBAM reports to the EU CBAM Portal, ensuring you meet all reporting requirements.

Emissions Assessment

We calculate carbon emissions for CBAM-covered goods, ensuring correct carbon price estimation & compliance with the EU ETS.

Carbon Footprint Reduction

Go beyond compliance. Optimize your supply chain and switch to low-carbon alternatives to reduce costs & future-proof your business.

Carbon Footprint Audit

A full audit of your product carbon footprint, ensuring accurate emissions data & identifying areas for improvement. , ensuring accurate emissions data & identifying areas for improvement.

InCorp InSights

Complete Overview of the Carbon Border Adjustment Mechanism

This article will serve as a guide for exporters and importers, majorly decision-makers, to grow their businesses responsibly while adhering to the new and updated CBAM Regulations. Along with discussing the specificities of Carbon Border Adjustment Mechanism Regulations, this blog will also talk about the CBAM Reporting requirements to ensure compliance and advantages for companies.

Have Questions?

Ensure Alignment with CBAM Today

Ensure Alignment with CBAM Today

Whether you need quarterly CBAM reporting, carbon footprint audits, emissions assessments, or sustainability consulting, we provide end-to-end support. Stay ahead of EU emissions trading system (ETS) requirements, avoid penalties, and position your business as a leader in corporate sustainability.

COPYRIGHT © 2025 | INCORP ADVISORY SERVICES PRIVATE LIMITED